This is what those of us in the real estate industry are hearing from homeowners. This is incredibly frustrating, given that it is a seller’s market in so many areas.

What does that mean? A seller’s market means there are a lot of buyers out there but very little inventory. One of the primary reasons for this is that the people who own the majority of homes are baby boomers and empty nesters who can’t find a place to go and are reluctant to leave homes where they have such a low-interest rate. But they are sitting a lot of equity and this could be a great time to cash in. If only they had a place to go…

While it’s true inventory is low, some areas are better than others. It can also vary widely by price range. So you want to make sure you have access to good market data so you know what you are dealing with.

Navigating a low inventory market requires creativity and persistence, but it is very possible. Here are some strategies to find homes:

1. Expand Your Search Radius: Cast a wider net by considering neighborhoods or areas slightly outside your initial target location. Sometimes, hidden gems can be found just a bit further from the most sought-after areas.

2. Utilize Multiple Platforms: Don’t rely solely on traditional real estate listings. Explore various platforms such as real estate websites, social media groups, local classifieds, and even word-of-mouth referrals from friends, family, and colleagues. Tell people what you are looking for, and ask them to let you know if they become aware of anything.

3. Work with Local Agents: I promise you this is not just a pitch. Establishing a relationship with a real estate agent who specializes in your desired area can make a huge difference. They often have access to off-market listings or upcoming properties that haven’t been publicly listed yet. Communicate your needs clearly to ensure they prioritize finding suitable options for you.

4. Direct Mail Campaigns: This may sound bold, but consider sending out targeted letters to homeowners in your preferred neighborhoods. Or even to a particular owner of a house you have always loved, to express your interest and provide your contact information.

5. Networking: Looking for a house can be a lot like looking for a job. Attend local real estate events, open houses, and community gatherings to network with homeowners, real estate professionals, and other potential sellers. Building connections can lead to insider information on upcoming listings or off-market opportunities.

6. Be Flexible: Remain open-minded and flexible regarding your preferences for the property. In a low inventory market, you may need to compromise on certain features or amenities to secure a home within your budget and timeframe.

7. Act Quickly: This is key. When a suitable property does become available, be prepared to act swiftly. Have your financing pre-approved, conduct thorough due diligence promptly, and submit a competitive offer to increase your chances of success. It is often not just the price that matters but the other terms and conditions. My team and I employ a whole host of strategies to ensure our clients have the most competitive offer whenever possible.

8. Stay Persistent: Persistence is key in a competitive market. Continue actively searching, refining your criteria, and get out there to look at various things until you find the right home that meets your needs.

If the interest is keeping you from selling, here are things a couple of things to consider:

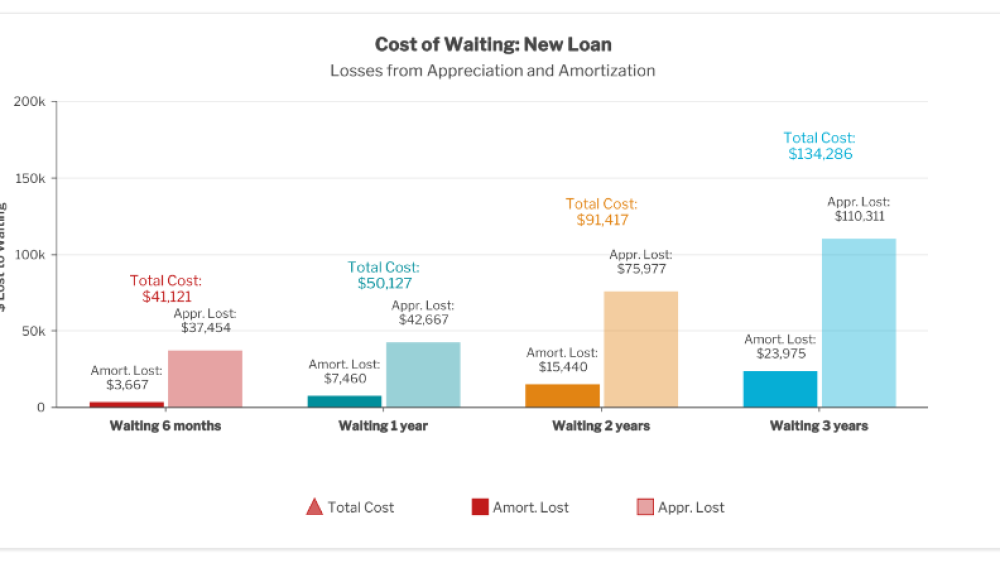

The Cost of Waiting: The cost of waiting to buy is not insignificant in many areas given how home values have appreciated. Look at this data:

This shows how much money a buyer could lose if they put off making a purchase. The graph breaks down the actual dollars a buyer might lose by waiting for 6 months, 1, 2, and 3 years before deciding to buy. It’s not just an idea — it’s real money slipping away. When you delay buying, you’re not just missing out on potential gains; you’re also dealing with increasing costs due to inflation and the market going up. The bottom line is that it’s worth thinking about the long-term effects before you decide to wait. A good loan officer should be able to pull this data more specific to the area you are looking in.

Homes can always be refinanced: If you find a home you love at a good price you can afford, don’t let the interest rate hold you back. You can always refinance.

These are big decisions and they are not one size fits all. If you would like to chat about your situation, I am here to help.